Wealth management is most important in a family and maintaining the proper capital and desire is much complex. The family members who wish to preserve the resource for the next generation, and to extend their business across the world can approach the family office service providers. They serve families with high-net-worth who will plan for budgeting, wealth transfer, tax services, and giving charities. The experts clearly understand the family needs, their goals, and create an efficient management plan to yield the highest returns.

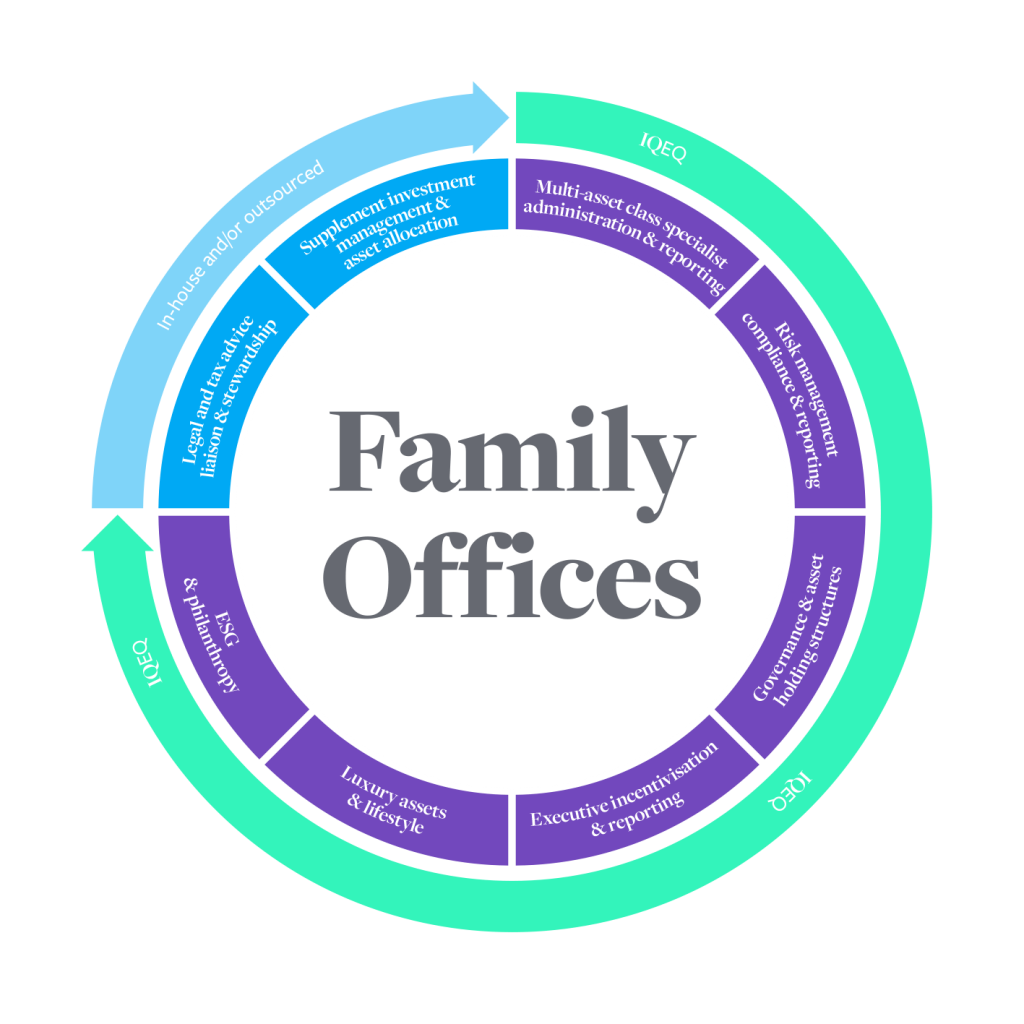

The professionals help people to deal with the issues like governance structure, interest alignment, family wealth, and extension of their business and centralizing it. They even provide essential services like management of assets, cash, risk, lifestyle, and financial planning.

You will get the benefit of viewing your savings and expense through their investment report they generate every month. As part of the investment, they give you the option to get more knowledge on real estate, private equity, venture capital, and tenant management. They assure to create awareness among the family members on wealth management and educating them by conducting regular meetings for the entire family.

The family office solutions experts give advice on family business areas like strategic planning, operational support, cash flow, capital management, compliance, corporate support, secretarial support, loan services, account openings, and maintenance. They offer a solution to investment and financial related managements. The trusted company will create a share path portal for the family members so that you can share it with the approved family members.